PAN Card Download: In today’s digital age, the Permanent Account Number (PAN) is more than just a tax identifier—it’s your financial passport. Whether you’re filing taxes, investing in stocks, or buying property, a PAN card is indispensable. This comprehensive guide walks you through every step of obtaining, managing, and securing your PAN card, ensuring you stay compliant and informed.

What is PAN Card?

A PAN card is a 10-digit alphanumeric identifier issued by the Income Tax Department. It includes:

- Your name, father’s name, and date of birth.

- A photograph and signature.

- A QR code for quick verification.

Note: Your PAN remains valid for life and doesn’t require renewal!

What is full form of PAN?

The full form of PAN is Permanent Account Number.

Why Do You Need a PAN Card?

Here are some key points why you need a Pan card-

- Tax Filing: Mandatory for individuals and businesses.

- Financial Transactions: Required for deposits above ₹50,000, mutual funds, or property purchases.

- KYC Compliance: Essential for bank accounts, Demat accounts, and SIM cards.

- Government Subsidies: Links subsidies like LPG to your identity.

Who Needs a PAN Card?

- Indian Residents: Individuals, minors, and businesses.

- NRIs and Foreign Nationals: For investments or business activities in India.

Documents Required for Pan card apply

Submit one proof each of identity, address, and date of birth.

| Category | Accepted Documents |

| Individuals | Aadhaar, Passport, Driving License, Voter ID |

| Minors | Parent’s PAN + Birth Certificate |

| Companies | Certificate of Incorporation |

How to Apply for a PAN Card?

Option 1: Online via NSDL/UTIITSL

- Visit the Portal: Go to NSDL or UTIITSL.

- Fill Form 49A: Enter personal and employment details.

- Upload Documents: Scan and upload proofs (JPEG/PDF, under 200KB).

- Pay Fees: ₹93 for Indian addresses (credit/debit card, UPI).

- Submit: Note your 15-digit acknowledgment number.

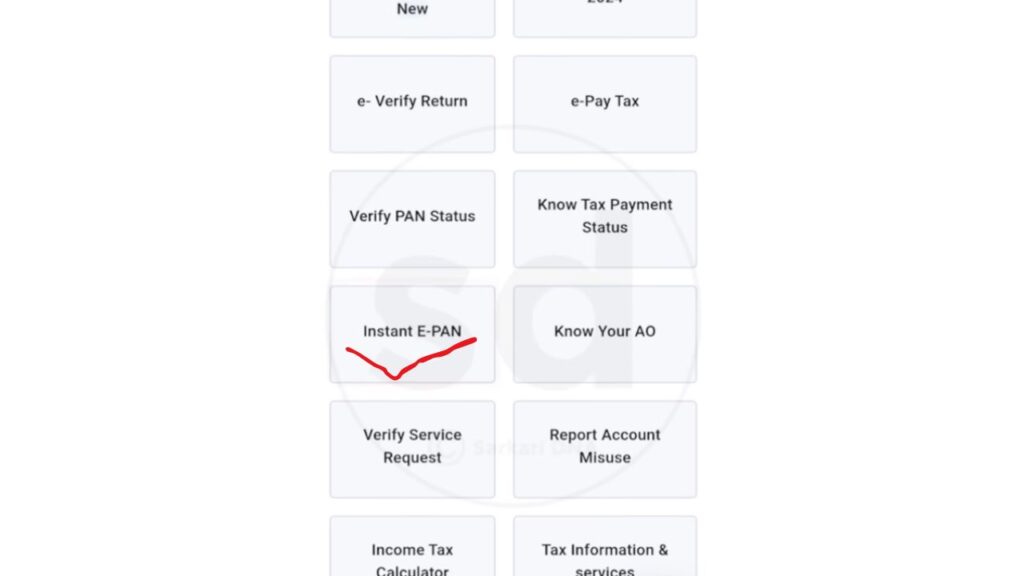

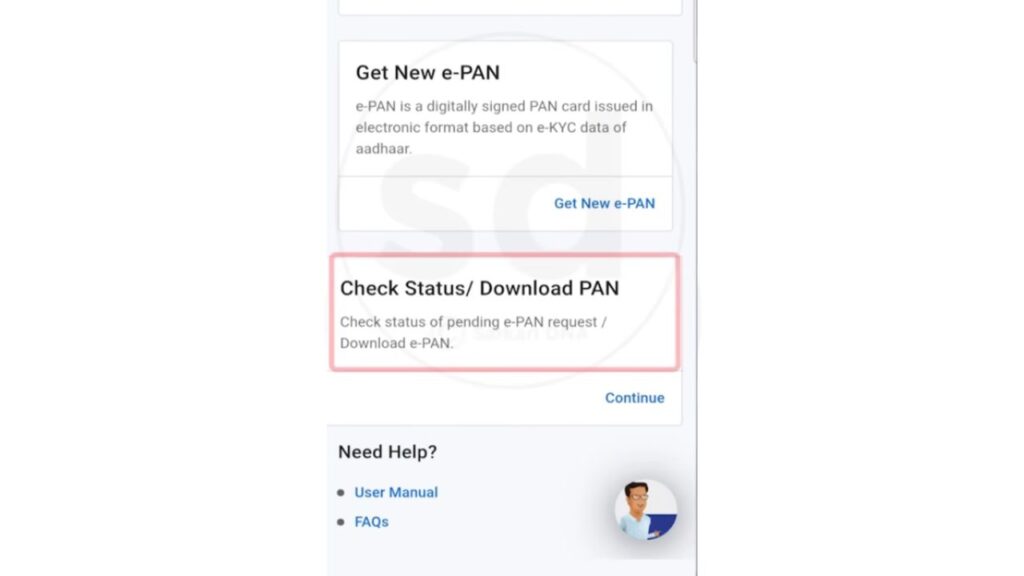

Option 2: Instant e-PAN (Free)

For Aadhaar-linked users:

- Visit the e-PAN Portal.

- Enter Aadhaar and OTP.

- Download e-PAN instantly.

Option 3: Offline Application

- Download Form 49A from NSDL/UTIITSL.

- Submit with documents and demand draft to a PAN center.

How to download PAN Card?

To download your PAN card follow the below steps-

Step 1: Go to the Official Website

Open your computer/tablet and visit:

👉 https://www.incometax.gov.in

Step 2: Click “Download PAN”

Look for the “Quick Links” section (like a shortcut in your game).

Click on “Download PAN”.

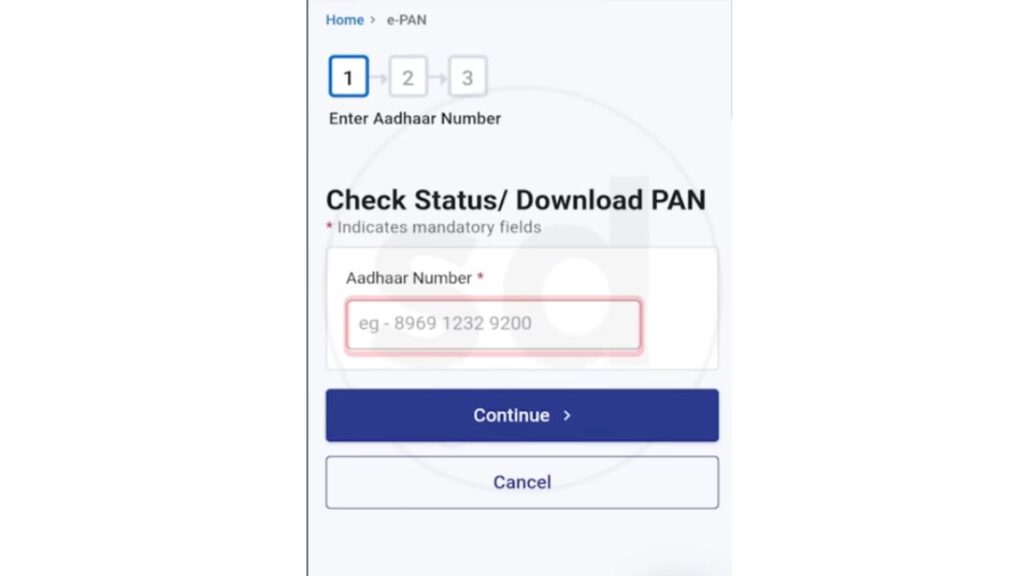

Step 3: Enter Aadhar Number

Type your aadhar number (e.g., ABCDE1234FGH) in the box.

Fill the captcha (those funny letters/numbers – like solving a puzzle!).

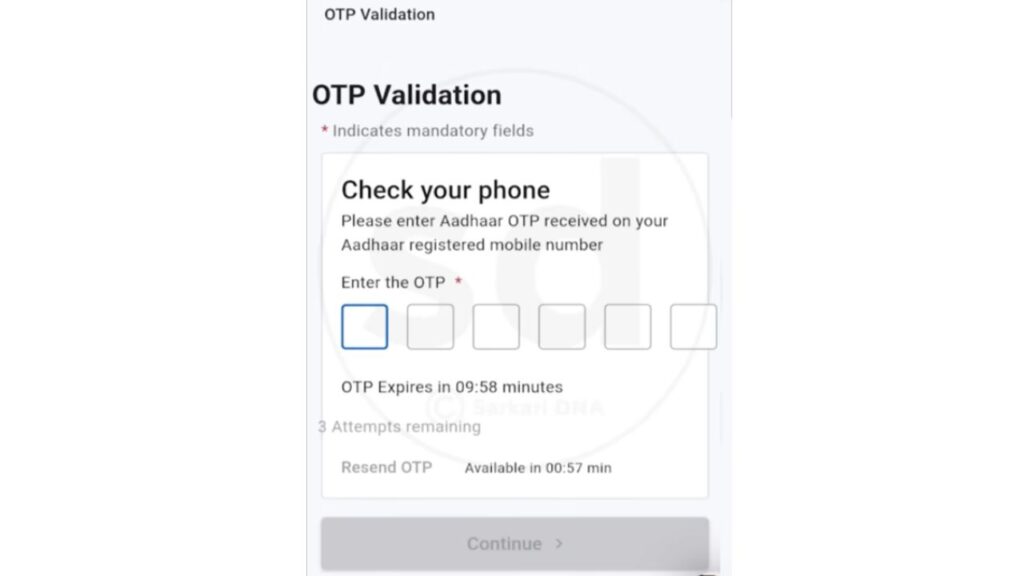

Step 4: Get OTP on Your Phone

Click “Generate OTP”.

A secret code (OTP) will come on your parent’s phone. Type it in!

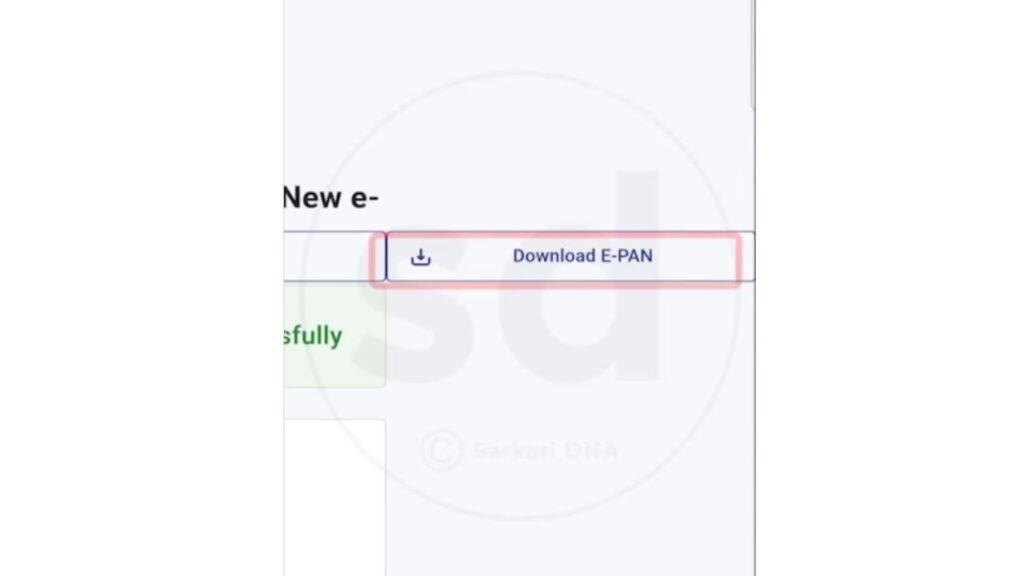

Step 5: Download Your PAN Card

Click “Download PDF” – your PAN card will save as PDF.

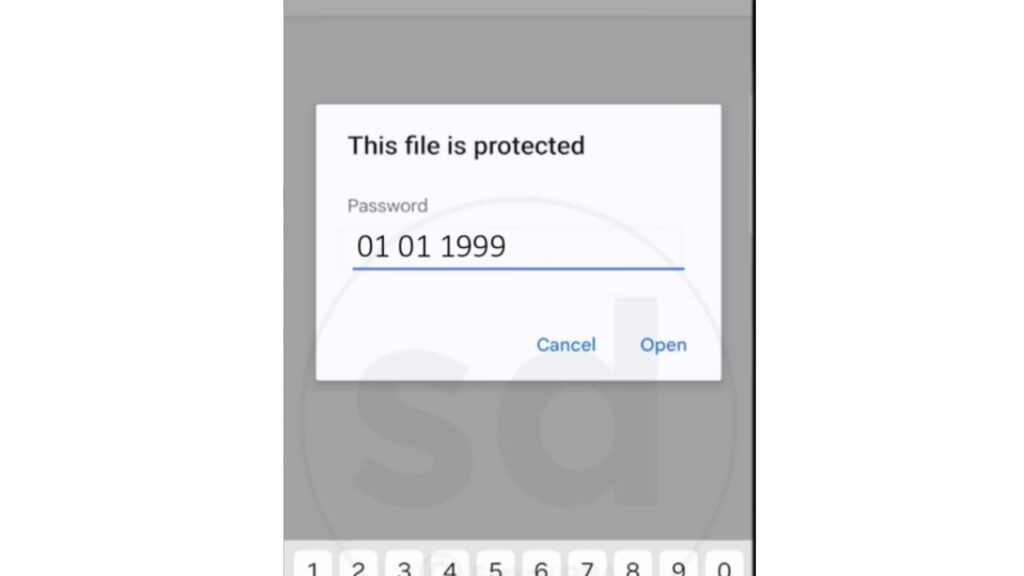

Step 6: Password Protection

Password Tip: Use birthday in DDMMYYYY format (e.g., 01 January 2010). And then unlocked.

Fees and Payment Options

| Service | Cost (₹) |

| New PAN (Online) | 93 |

| Reprint (Lost PAN) | 50 + GST |

| Foreign Applicants | 864 |

Track Your PAN Application

- Visit NSDL Tracking.

- Enter your 15-digit acknowledgment number.

- Check status updates like “Dispatched” or “Under Process.”

How to Download e-PAN?

- Visit the e-PAN Portal.

- Enter PAN/Aadhaar and authenticate via OTP.

- Download the PDF (password: DDMMYYYY format of your birthdate).

How to Update PAN Details?

Changed your name or address?

- Submit Form 49A (mark “Changes/Correction”).

- Pay ₹110 (online) and upload supporting documents.

- Send physical copies to NSDL/UTIITSL if required.

What to Do for Lost PAN Card?

Follow the below points

- Apply for a duplicate PAN via the “Reprint” option.

- Submit an affidavit for lost PAN.

- Cost: ₹50 + GST.

PAN vs. e-PAN

| Feature | Physical PAN | e-PAN |

| Format | Plastic card | Digital PDF |

| Delivery Time | 15–20 days | Instant |

| Use Cases | Physical verification Online KYC | Email submissions |

Benefits of e-PAN Over Physical PAN

Instant Access: No waiting for postal delivery.

- Eco-Friendly: Reduces plastic waste.

- Secure Sharing: Password protection prevents misuse.

- Portability: Store on smartphones via apps like DigiLocker or mParivahan.

Protecting Your PAN

- Avoid Sharing: Never post PAN on social media.

- Mask PAN: Use only the last 4 digits (e.g., XXXXX1234F) for non-official use.

- Secure Storage: Keep physical PAN in a locker; encrypt digital copies.

FAQs

Q1. Can I apply PAN without Aadhaar?

Yes! Use a passport, driving license, or voter ID instead.

Q2. How long does it take to get PAN?

Physical card: 15–20 days.

e-PAN: Instant download.

Q3. Is PAN mandatory for minors?

Yes, for investments or bank accounts in their name.

Q4. What if my PAN application is rejected?

Correct errors (e.g., name mismatch) and reapply.

Q5. Can NRIs apply for PAN?

Yes, using Form 49AA and foreign address proof.

Conclusion

PAN Card Download is now very easy just visit the official site and download it. Navigating the PAN card process doesn’t have to be daunting. With options for instant e-PAN downloads and streamlined online applications, securing your financial identity is easier than ever. Always rely on official portals (NSDL, UTIITSL) to avoid scams, and safeguard your PAN like you’d protect your wallet.